- Home

- About Us

-

Services

-

Initial Public Offering advisory services

-

Standard Operating Procedures

-

Organisational Policies

-

Implementation of complex financial processes

-

Accounting support services

-

Implementation of Internal control over financial report (ICFR)

-

Technology and system audit

-

Accounting GAAP conversions (IGAAP to Ind AS/IFRS)

-

Physical verification of assets

-

Virtual CFO services

-

- Insights

- Talk to an expert

- Contact Us

Initial public offering (IPO) advisory services

Taking an SME public through an Initial Public Offering (IPO) is a significant milestone in Company's growth journey.

The eligibility criteria for listing on BSE SME exchange.

- Post issue capital - Post issue paid up Capital of the company shall not be more than Rs.25 Cr

- Net profit from last 3 years company for atleast two years company should be profitable

- Net worthshould be 1 crore for two preceding full financial year.

- Track record of the issuer company should be atleast 3 years

- Net tangible assets should be 3 cr in last preceding financial year.

The eligibility criteria for listing on NSE SME exchange.

- Post issue capital - Post issue paid up Capital of the company shall not be more than Rs.25 Cr

- Track record of the issuer company should be atleast 3 years

- Positive Ebita for at least 2 out of 3 preceding financial years

- Positive net worth

The eligibility criteria for listing on Main board. The company must satisfy either the Profitability Route or QIB route:

- Post issue capital - Post issue paid up Capital of the company shall not be more than Rs.25 Cr

- Net tangible assetsshould be 3 cr in during the three preceding financial years.

- Average operating profit should be atleast 15 cr in during the three preceding financial years.

- Positive net worth of atleast 1 cr in preceeding three years in case the above conditions are not satisfied the entity can follow QIB route.

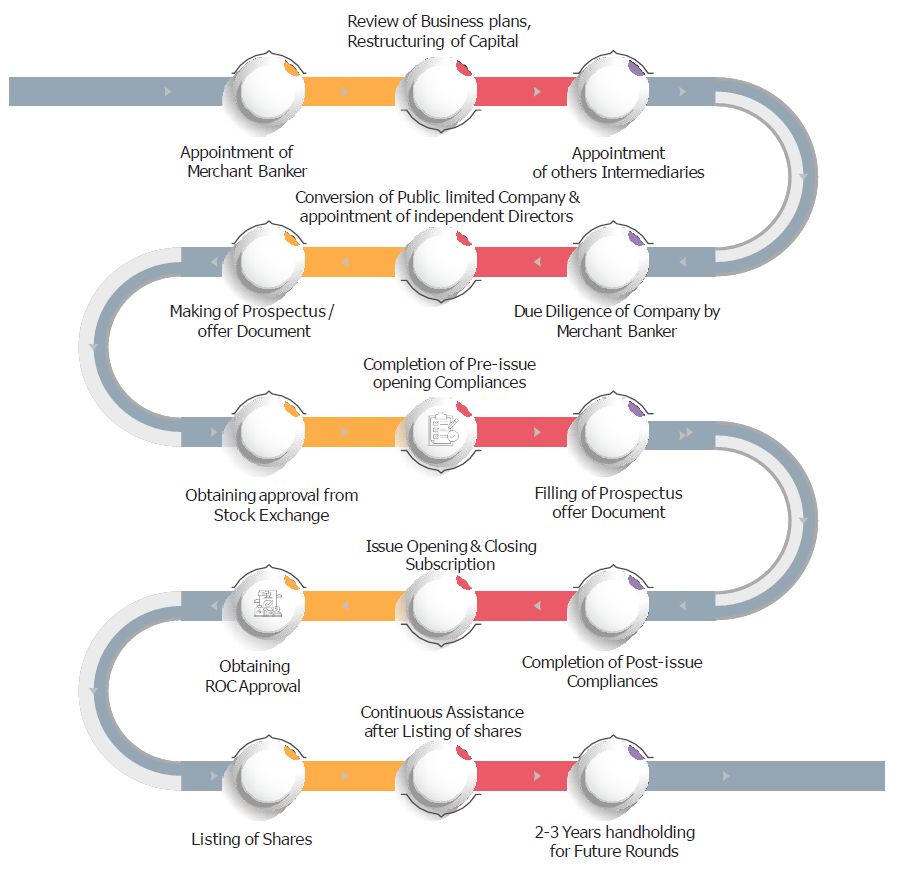

SME listing typically involve the following

process:

SME listing typically involve the following

process:

Benefits of listing

- Access to Capital: Listing allows Company to raise capital from the public, enabling them to fund growth initiatives, expand operations, or pay off debts.

- Enhanced Credibility:Becoming a listed company enchances visibility and credibility among customers, suppliers, and investors, which may potentially lead to new business opportunities and partnerships.

- Liquidity for promoters and Investors: Promoters and early investors can monetize their investments by selling securities (or part thereof).

- Employees - stock options may be used as a strategic tool to attract and retain talent. Offering shares/stock options to employees aligns their interests with the company’s objectives and can act a motivational tool that encourages loyalty and dedication.

- Improved corporate governance - Listing requires compling to stricter corporate governance norms, financial disclosures and standards. This can improve management practices, attract seasoned professionals to the board, and enhance governance of the Company.

Why Right Idea?

Why Right Idea?

- Right Idea is a team of professionals who assists the Company to list its securities on recognised stock exchange. Our team of experts work closely with the team of merchant bankers, lawyers, bankers, auditors and other IPO intermediatories.

- The promoter group and Chief financial officer has a single point contract "Right Idea" team member to address all queries related to IPO. Thereby in the entire IPO process the management time is devoted only on specific key areas which in turn economise the time and effort involved in the entire process.

- To provide advisory inputs in the process to assist the management take well informed decisions.